Weekly appointment with the world’s most watched chart.

The S&P 500 just set another all-time high. Another centimeter à la Duplantis — the bare minimum to make the history books. The permabull vs. permabear battle rages on: the bulls have been celebrating for five years (the selloffs didn’t even last long enough to worry about), while the bears keep repeating “yes, new high, but we’re still right there.”

Let’s establish the facts.

The Big Picture

The simplest chart is often the most effective: just simple moving averages, no noise.

S&P 500 trades above MA5W (white) > MA10W (green) > MA20W (orange) > MA50W (red) > MA100W (purple) > MA200W (amaranth).

A textbook perfect bull market. But there’s more: short-term growth has rarely ripped, keeping overextensions contained on the faster moving averages (MA5W-MA10W). This signals sustainability — a slow but steady pace the market can maintain for extended periods.

Practically unsinkable? Let’s see what the numbers say.

The Framework: MA20W and MA200W

Switching to a closing-price chart and keeping only MA20W and MA200W reveals a fundamental insight: the MA20W has been the support line for every S&P 500 rally since 2020. We’re now in the third bullish wave — nothing to do with Elliott wave counts, it’s literally the third wave visible on the chart.

How do we use it?

In the simplest way possible: S&P 500 is above it, and as long as it stays there, it’s bull. If it drops below, it’s bear — and a meaningful correction becomes likely.

Too simple? I’m not concerned. This is what the market has been telling us. Identifying a trend doesn’t have to be rocket science.

And the MA200W? It’s clearly the natural target for any potential correction. But more importantly, its overextension deserves attention.

40 Years of Overextensions: The Statistical Framework

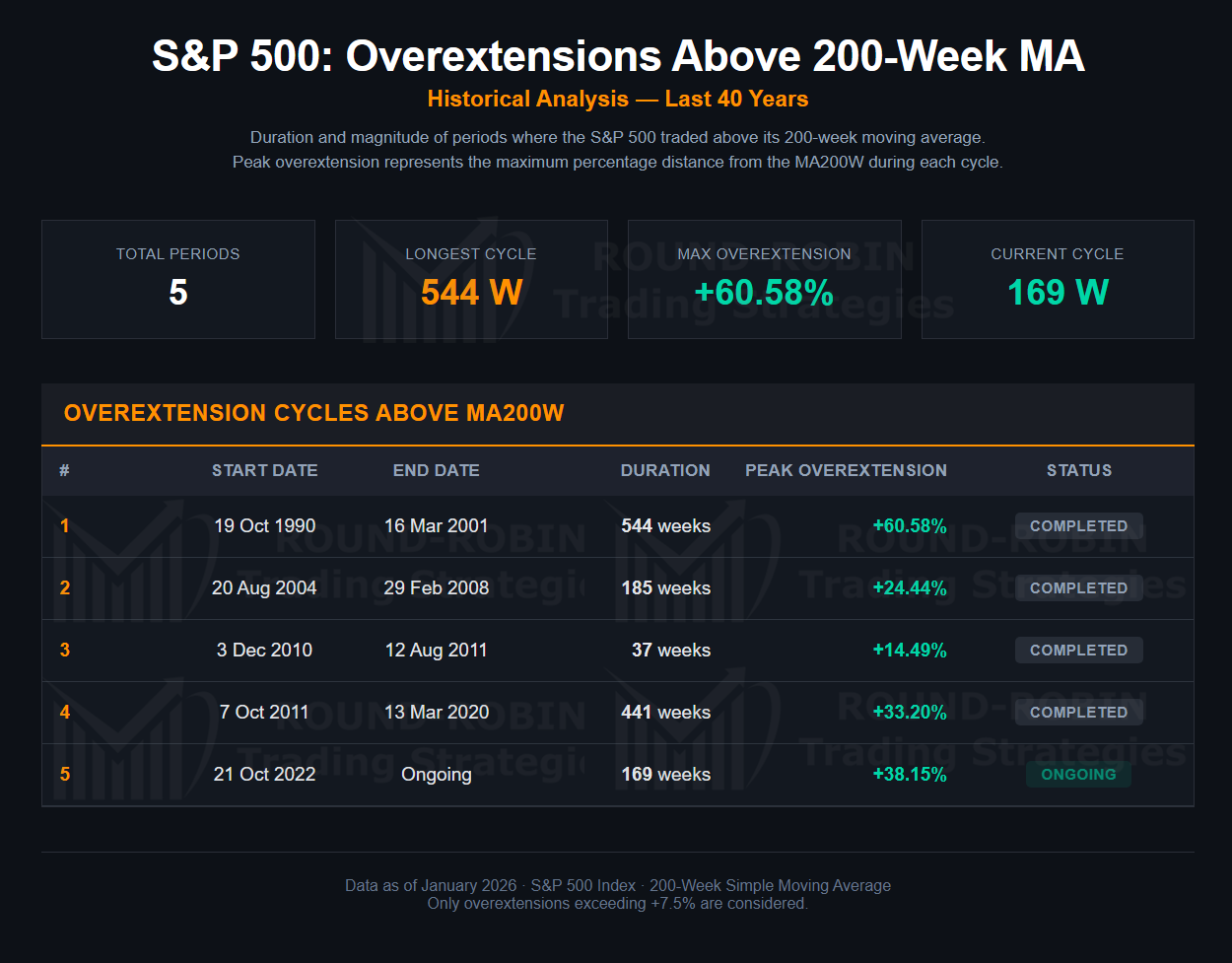

How long does the S&P 500 stay above the MA200W after overextending? I’ve analyzed 40 years of data to answer this question.

The numbers speak clearly. In 40 years, there have been only 5 significant overextension cycles (above +7.5% from MA200W):

Cycle 1 (1990-2001): 544 weeks, peak +60.58%. The golden decade of the dot-com bubble.

Cycle 2 (2004-2008): 185 weeks, peak +24.44%. Pre-financial crisis.

Cycle 3 (2010-2011): 37 weeks, peak +14.49%. The shortest — interrupted by the European debt crisis.

Cycle 4 (2011-2020): 441 weeks, peak +33.20%. The second longest bull market, ended by COVID.

Cycle 5 (2022-present): 169 weeks, current peak +38.15%. Ongoing.

What These Numbers Tell Us

In terms of duration: the current cycle (169 weeks) still has room. The longest cycle lasted a decade (544 weeks), the pre-COVID one 441 weeks. We’re at roughly one-third of the historical average.

In terms of magnitude: here the story differs. The current +38.15% is already the second highest level ever recorded, exceeded only by the 2000 peak (+60.58%). The psychological 40% threshold: hard to maintain and even harder to extend.

The key reading: this doesn’t mean the market will fall. Overextensions can be absorbed even if prices stabilize for extended periods — a crash isn’t necessary to close the gap. But it does suggest we probably won’t see dramatic upside rips from here.

The Indicator Paradox

On the weekly timeframe, RSI isn’t even overbought despite the all-time high — true. But it shows a bearish divergence versus the previous year — also true.

So what will happen? Will it push into deep overbought territory, or will the bearish divergence demand its toll?

We don’t know and neither does anyone else — unless the game is rigged, which I don’t think it is. Technical analysis doesn’t make predictions: it helps make decisions with statistical support.

You see charts out there with lines everywhere, quadrants, fabulous wave counts that get retroactively adjusted so the count works out. Sometimes you need to subtract, not add.

When This Framework Tells Us We’re Wrong

No framework is complete without defining failure conditions.

If you’re bullish: a breach of MA20W is the first warning bell. Post-COVID, every breach has led to corrections of varying depth. Until that happens, S&P 500 will keep flirting with MA5W and MA10W, bouncing off and resuming.

If you’re bearish: the +40% extension above MA200W deserves attention as a potential statistical ceiling. But to even hypothesize a mini correction, you first need to see MA20W break. Until then, the market isn’t giving you any confirmation.

Conclusion

Bull as long as it stays above MA20W. Historical data suggests there’s still room in terms of cycle duration, but less margin in terms of overextension magnitude.

What does the framework suggest? The S&P 500 is technically set up for continuation. There are no reversal signals — only the statistical awareness that extreme overextensions tend to normalize, one way or another.

Forty years of data. Five cycles. One level to watch. That’s what we know — the rest is risk management.

New to terms like overextension or moving averages? We cover technical concepts every Monday in Pattern Decoded (theory) and every Wednesday in Pattern Spotted (applied examples). Options strategies are part of our advanced Trading Academy program — coming soon.

Leave a Reply