Pattern Decoded is our Monday format where we cover the most well-known patterns in technical analysis. This week we talk about the Double Top.

Double Top: What It Actually Is (And What It Isn’t)

Let’s clear something up.

Price touches a previous high for the second time and half the internet screams “Double Top!” Social media fills with bearish calls. Everyone becomes a pattern expert.

That’s not a double top. That’s a wish for a double top. A bias dressed up as analysis.

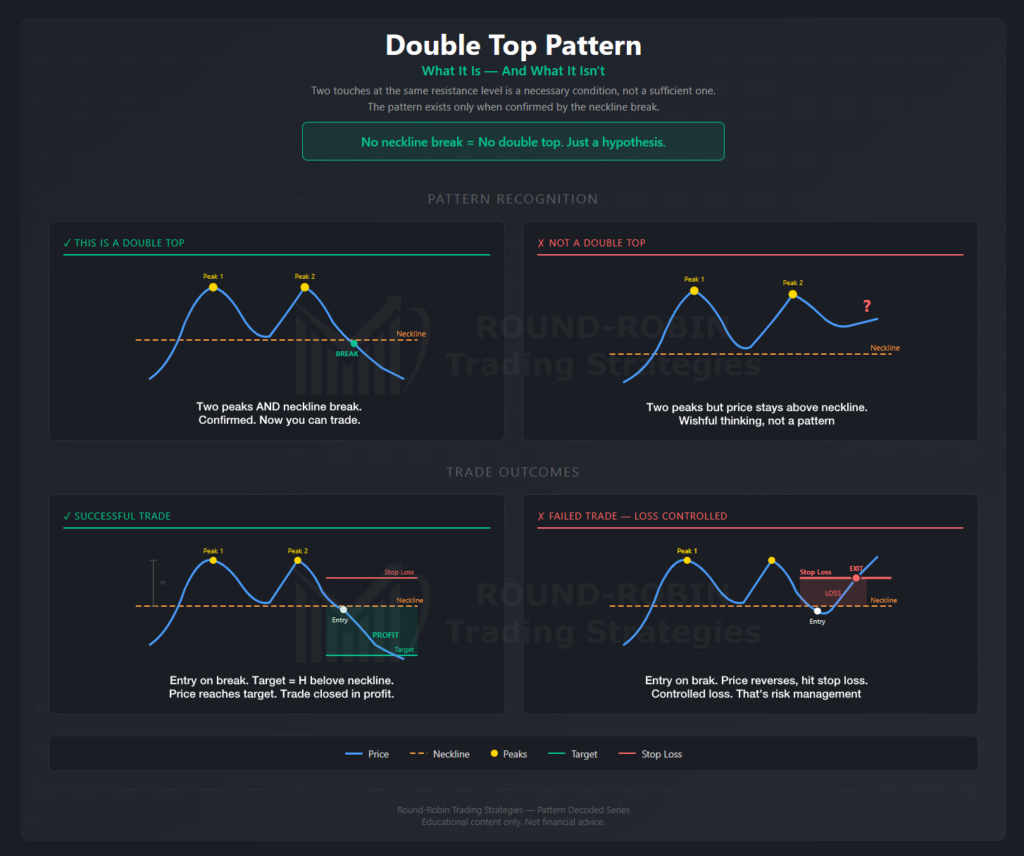

Two touches at the same resistance level is a necessary condition, not a sufficient one.

A double top doesn’t exist when price hits resistance twice. It exists when price confirms it can’t break through — and the only confirmation that matters is the break of the neckline.

The neckline is the low between the two peaks. Until price closes below it, you have nothing. You have two peaks and a hypothesis. You have a chart that could become a double top but isn’t one yet.

The distinction matters because acting on incomplete patterns is how traders get destroyed. You short at the second peak, convinced the pattern is “obvious,” and price rips through resistance into new highs. Now you’re stopped out, frustrated, wondering why technical analysis “doesn’t work.”

It works. You just didn’t wait for it.

The sequence:

1. Price makes a high (Peak 1)

2. Price pulls back (forms the trough — this low becomes your neckline)

3. Price rallies again but fails near the previous high (Peak 2)

4. Price breaks below the neckline

Step 4 is the pattern. Steps 1-3 are just setup.

The two peaks don’t need to be identical. Close enough works. What matters is that both attempts failed at roughly the same level — that’s your resistance. And once the neckline breaks, that resistance becomes meaningful because it proved the buyers couldn’t push through despite two tries.

Money Management

Entry: Short when the neckline breaks.

Target: Project the distance between the peaks and the neckline downward from the break point. That’s your theoretical target.

Stop loss: Two approaches depending on your risk tolerance.

Conservative: Price closes back above the neckline plus a margin. The margin depends on the instrument’s volatility — you need room for noise, but not so much that a failed trade becomes a disaster.

Aggressive: Price breaks above the two peaks. At that point, the pattern isn’t just invalidated — it’s reversed. Get out.

The instrument matters. If you’re trading short calls, you have time decay working for you and defined maximum loss. You can afford to give the trade more room. If you’re shorting futures or leveraged ETFs, you’re exposed to unlimited downside and margin calls. Fix mistakes fast. Here, “fix” means stop loss — no exceptions, no hoping.

The tighter your leverage, the tighter your stops need to be. That’s not optional. That’s survival.

Next time you see price touch a high twice, ask yourself: has the neckline broken?

If the answer is no, you’re not looking at a double top.

You’re looking at your own expectations.

Leave a Reply